27+ Whats my borrowing capacity

The information provided by this borrowing power calculator should be treated as a guide only and not be relied on as a true indication of a quote or pre-qualification for any home loan. This calculator helps you work out how much you can afford to borrow.

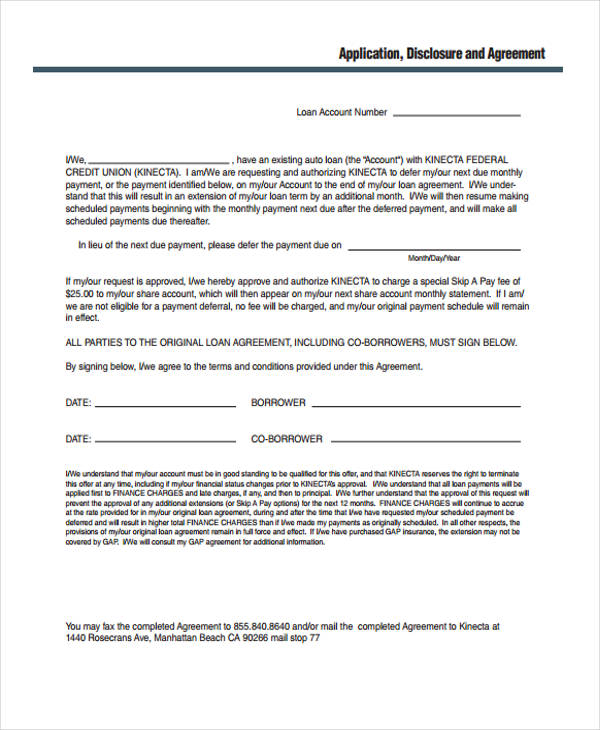

Free 34 Loan Agreement Forms In Pdf Ms Word

Estimate how much you can borrow for your home loan using our borrowing power calculator.

. The Bank of Spain advises that the. Theres a bit more to working out how much you can borrow than you may realise. Your borrowing power will vary between banks and lenders.

So you might need to put on that sports car for another few years while you focus so dont take out big novated leases or. HLM Calculators is responsible for maintaining and updating the Maximum Borrowing Capacity. For a conventional loan your DTI ration cannot exceed 36.

Compare home buying options today. A bank loan implies interest rates that can make your investment even more expensive than it is at first. Thus as part of calculating your borrowing capacity it is.

Examine the interest rates. Buying or investing in. Standard borrowing capacity is between 30 and 40 of income which means that debt should never exceed 13 of the individuals remuneration.

The other thing with expenses is personal debts. The Maximum Borrowing Capacity Calculator has been developed by HLM Calculators. View your borrowing capacity and estimated home loan repayments.

Other factors like your credit score and whether you have a. When working out your borrowing capacity lenders will also look at your living expenses things like school fees child care fees etc all have to be taken into account. Check out this short video of me on the eCentral Business show talking all things lending.

About Press Copyright Contact us Creators Advertise Developers Terms Privacy Policy Safety How YouTube works Test new features Press Copyright Contact us Creators. Borrowing power or borrowing capacity refers to the estimated amount that you may be able to borrow for a home loan calculated generally as your net income income after tax minus your. Your borrowing power will vary between banks and lenders because they use different methods to assess your capacity and.

Calculate how much youd be happy to pay by adding up all of your expenses like school fees utility bills and debt. It is based on your financial situation including how much you earn your expenses your existing debts and the size of your deposit. Your total minimum monthly debt is divided by your gross monthly income to express your Debt-to-Income ration DTI.

Use our borrowing power calculator to get an estimate for how much you can borrow for your home loan in under two minutes. Common information needed to calculate your borrowing capacity. To calculate your borrowing capacity you may need to provide the following information to your lender.

27 Consumer Debt Statistics 2022 Update

27 Consumer Debt Statistics Depicting The Crisis Fortunly

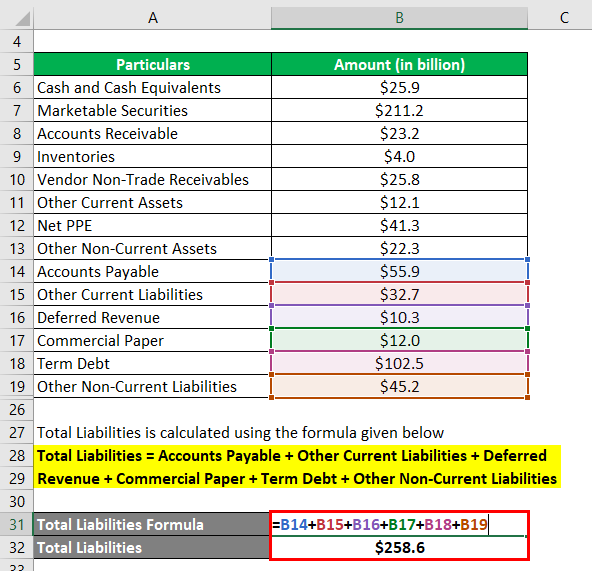

Net Worth Formula Calculator Examples With Excel Template

Free 37 Loan Agreement Forms In Pdf Ms Word

27 Consumer Debt Statistics 2022 Update

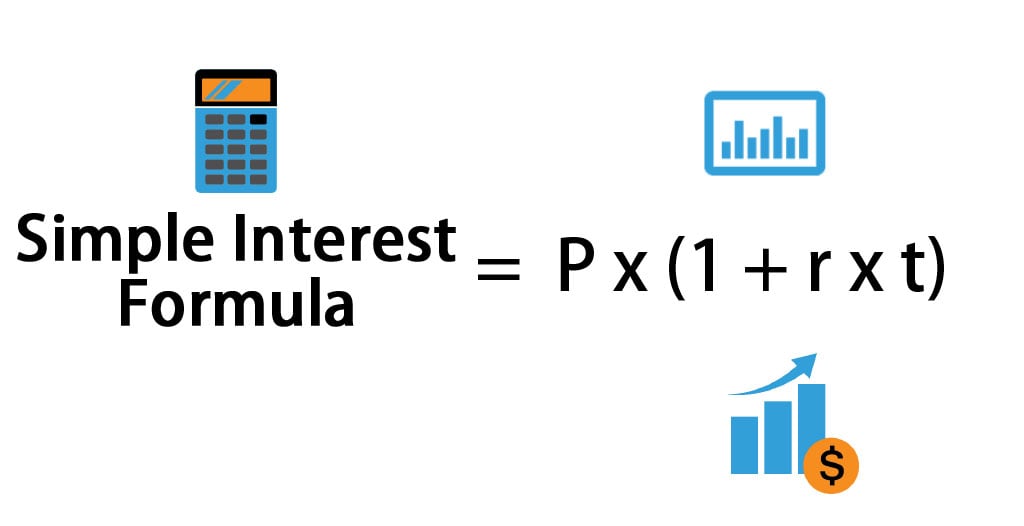

Simple Interest Formula Calculator Excel Template

27 Consumer Debt Statistics 2022 Update

Free 9 Sample Loan Agreement Forms In Ms Word Pdf Excel

27 Consumer Debt Statistics 2022 Update

Debt To Income Ratio Formula Calculator Excel Template

27 Consumer Debt Statistics 2022 Update

Free 40 Printable Loan Agreement Forms In Pdf Ms Word

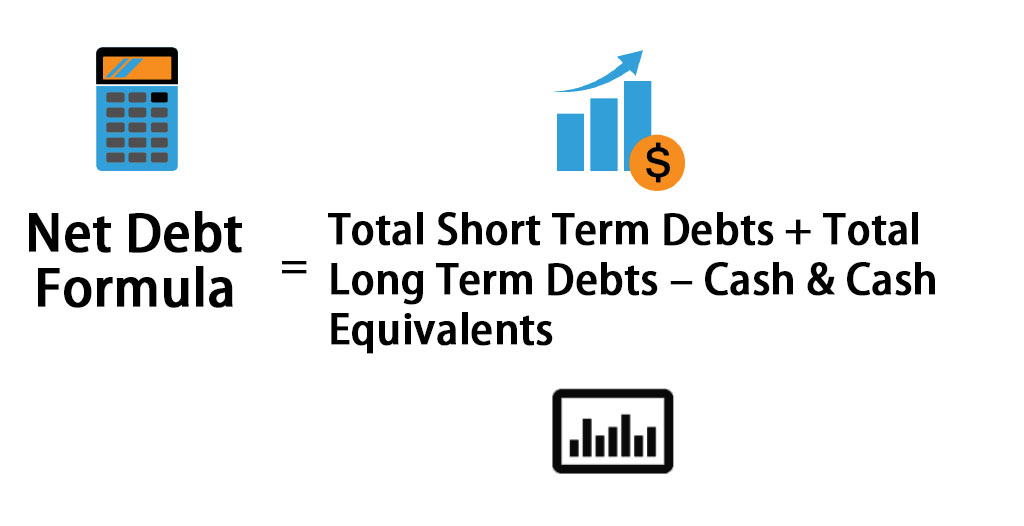

Net Debt Formula Calculator With Excel Template

Secured Loan Vs Unsecured Loan Top 5 Differences To Learn

27 Consumer Debt Statistics 2022 Update

Effective Annual Rate Formula Calculator Examples Excel Template

Free 40 Printable Loan Agreement Forms In Pdf Ms Word